HM Revenue & Customs

757 articles

Showing 601-630

HMRC’s High Net Worth Unit brings in £1 billion

Thursday, 17 July 2014

HMRC's High Net Worth Unit – a specialist division which deals with the tax affairs of the UK’s wealthiest individuals – has brought in £1bn in compli...

Avoidance schemes members to make upfront payments

Tuesday, 15 July 2014

A list of tax avoidance schemes whose users may be required to make an upfront payment of tax has been published today by HMRC....

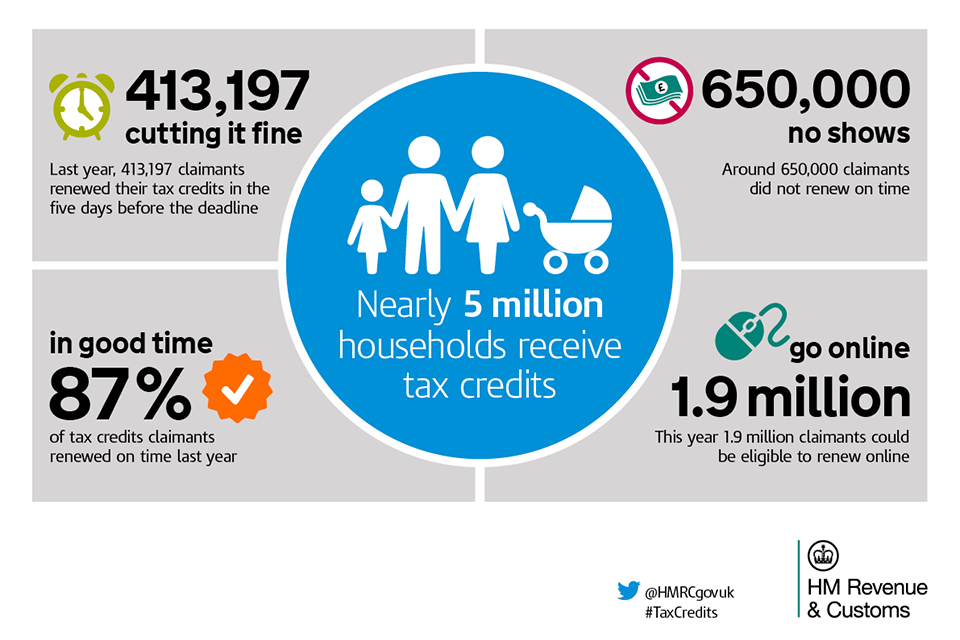

Top 10 tax credits renewal ‘excuses’ revealed

Monday, 14 July 2014

With the tax credits renewal deadline of 31 July just over two weeks away, HMRC has revealed the top 10 excuses for not renewing tax credits claims....

Tax credits online renewal form launched

Wednesday, 02 July 2014

With the tax credits renewal deadline of 31 July less than one month away, HMRC has launched a new online service for the vast majority of claimants t...

Court rules there's no tax relief for McLaren fine

Wednesday, 18 June 2014

Formula 1 racing giant McLaren has lost its claim that a £32 million fine imposed against it by the sport’s governing body should be tax deductible. ...

Tax credits claimants warned over scam emails

Monday, 16 June 2014

Tax credits claimants are being warned about scam or “phishing” emails sent out by fraudsters in the run-up to the 31 July renewal deadline....

Digital services suppliers get one stop EU VAT service

Monday, 09 June 2014

Businesses supplying digital services across the European Union will be able to use a one-stop VAT service from January. ...

HMRC secures record £4.6m minimum wage arrears for underpaid workers

Thursday, 05 June 2014

Over £4.6 million in wage arrears has been paid to more than 22,000 workers following a successful year for HMRC's National Minimum Wage enforcement t...

Tax credits claimants reminded to renew it or lose it

Tuesday, 03 June 2014

Tax credits customers are being prompted, through an advertising campaign launched today, to renew their claim now....

Tribunal tears up Next’s tax relief claim

Wednesday, 28 May 2014

A multi-million pound tax allowance claim made by one of the UK’s largest clothing retailers has been rejected for the second time by a tax tribunal....

Landlords get online tax training

Tuesday, 20 May 2014

Landlords are being offered online training in tax matters from HM Revenue and Customs (HMRC)....

Tribunal ruling halts charity tax relief abuse

Friday, 16 May 2014

Another attempted abuse of the tax relief available when shares are gifted to charities has been blocked by a tribunal....

HMRC defeats NT Advisors again at a tax tribunal

Wednesday, 14 May 2014

Another avoidance scheme designed by NT Advisors has been defeated at a tax tribunal....

Icebreaker tax avoidance scheme crushed

Monday, 12 May 2014

A tax avoidance scheme that created tax losses out of nothing for wealthy people and could have cost the taxpayer £120 million was rejected by a tax t...

Government to take direct action to recover tax and tax credit debts

Tuesday, 06 May 2014

Direct Recovery of Debts will see tax debts recovered from those refusing to pay....

Tax avoidance scheme could double brewer’s bill

Monday, 28 April 2014

A tax avoidance scheme designed to make taxable interest payments disappear has been blocked for the second time by a tax tribunal....

HMRC to host seminar on new VAT rules

Monday, 14 April 2014

HM Revenue and Customs (HMRC) is hosting a free seminar on 2 June 2014 to help businesses understand the incoming changes to VAT place of supply rules...

Tribunal holds recruiter to account for temps’ tax bill

Friday, 11 April 2014

One of the UK’s largest employment agencies, Reed, has been found liable for up to £158 million of unpaid tax due on the salaries of thousands of temp...

Estate agents get guidance to block money laundering

Monday, 07 April 2014

HM Revenue and Customs (HMRC) has published new guidance to help estate agency businesses stay on the right side of Money Laundering Regulations....

HMRC reveals 10 worst excuses for not paying the minimum wage

Thursday, 03 April 2014

Employers are giving elaborate excuses for not paying the National Minimum Wage (NMW) when challenged by HM Revenue and Customs (HMRC) officers, the d...

Retailer held to account over corporation tax bill

Thursday, 27 March 2014

The Court of Appeal has ruled that a member of an online retail group must pay corporation tax on VAT repayments, in a judgment that could safeguard u...

Health workers given one week to pay their tax or face taskforce

Thursday, 27 March 2014

Workers in the health and wellbeing professions who have taxable income that they haven’t revealed have one week to pay the tax they owe, or risk HM R...

HMRC makes online changes to Employment Related Securities

Wednesday, 26 March 2014

Online self-certification and filing processes for employee share schemes are to be launched by HM Revenue and Customs (HMRC)....

HMRC recruiting more digital specialists

Monday, 17 March 2014

HM Revenue and Customs (HMRC) is inviting further applications from digital specialists to help us transform the way we deliver services for 50 millio...

Employers urged to file Pay As You Earn returns

Monday, 17 March 2014

More than 70,000 employers are being urged to send employees’ Pay As You Earn information in real time or face penalties, HMRC announced today. ...

HMRC launches international tax training programmes

Tuesday, 25 February 2014

HMRC has announced details of 2 international training programmes for tax professionals....

Second hand car dealer tax scheme scrapped

Friday, 21 February 2014

A tribunal has found that a tax avoidance scheme which involved celebrities, fund managers and other high earners claiming that they were second-hand ...

Bristol & West tax avoidance plan loses again

Thursday, 20 February 2014

Bristol & West plc, owned by Bank of Ireland, has lost its second attempt to avoid £27 million of corporation tax by claiming that there was a loophol...

HMRC teams up with CIPP for end of year reminder

Monday, 17 February 2014

HMRC is reminding employers who are not represented by professional bodies about changes to the end of year submission process....

Small businesses urged to cash in with simpler accounting

Monday, 17 February 2014

Small businesses are being urged to consider a scheme that allows them to be taxed on money that flows in and out of their business, rather than using...